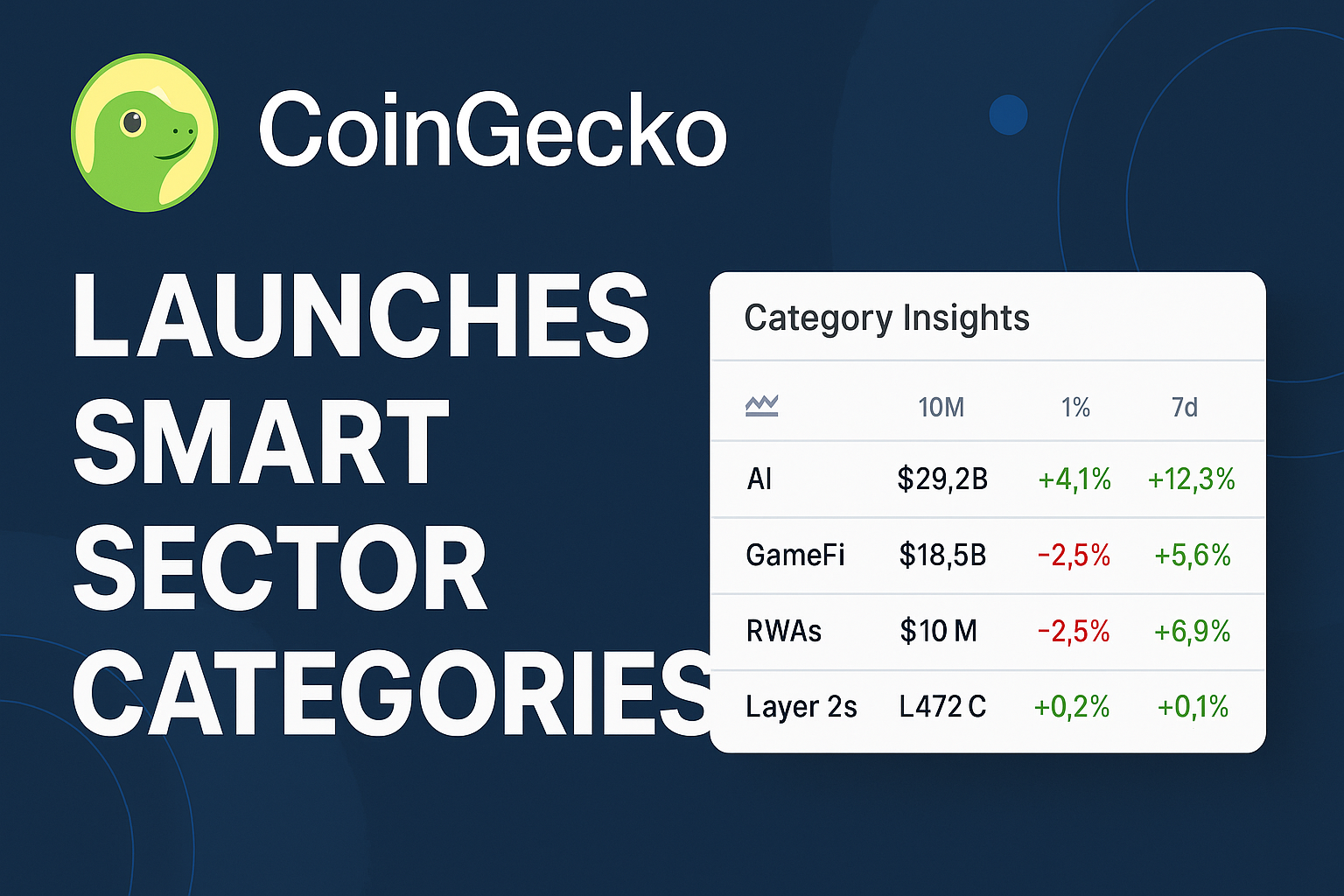

In a significant step toward improving transparency and analysis in the digital asset ecosystem, CoinGecko, one of the world’s most trusted cryptocurrency data aggregators, has unveiled a powerful new feature: Smart Sector Categories. This enhancement enables users to track cryptocurrencies by functional categories, such as AI, GameFi, RWAs (real-world assets), Layer 2s, and more—making it easier than ever to analyze market trends based on actual use cases.

With thousands of tokens now live and the crypto landscape becoming increasingly fragmented, CoinGecko’s upgrade aims to cut through the noise and bring structure to chaos. Traders, institutional investors, and retail users alike now have a more intuitive way to explore sectors, compare performance across similar projects, and uncover emerging opportunities.

What Are Smart Sector Categories?

Unlike traditional categories based solely on token type or blockchain affiliation, CoinGecko’s new Smart Sector Categories group assets based on their utility, economic function, and protocol focus.

For example:

Projects like Aave, Compound, and Maple Finance now fall under “DeFi Lending.”

Tokens like Fetch.ai, SingularityNET, and Ocean Protocol are grouped into the “AI & Big Data” category.

Platforms such as Immutable X and Ronin fall under “GameFi & Web3 Gaming.”

Each category features:

Real-time market cap tracking

Daily/weekly/monthly price performance

Number of assets and total volume

Top gainers/losers in the sector

Charts comparing sector-wide trends

The categories are dynamic and updated continuously by CoinGecko’s research team, ensuring accuracy and timeliness.

Why It Matters for Traders and Investors

Until now, tracking crypto by sector often required multiple third-party tools, spreadsheets, or guesswork. CoinGecko’s move brings institution-grade data clarity directly to public users.

According to COO Bobby Ong, this feature is “designed to serve both sophisticated investors and casual users. In traditional finance, sector-based investment strategies are standard—we want to bring that discipline into crypto.”

With sector-level filtering, users can:

Compare ROI of sectors like L1s (e.g., Ethereum, Solana) vs. RWAs (e.g., Ondo, Centrifuge)

Spot early breakouts in under-the-radar themes

Track sector rotation trends, just like in equity markets

Make thematic bets, such as AI or DePIN (decentralized physical infrastructure networks)

Implications for Market Behavior

Analysts expect this move to influence both trader behavior and project visibility. By surfacing sector-wide performance data, retail investors can quickly assess which niches are outperforming, potentially leading to capital rotation across themes.

Moreover, token projects that previously flew under the radar—due to lack of exchange listings or media exposure—could gain traction by ranking high within their sector.

Institutional players may also find value, as the feature offers instant exposure to niche sectors without relying on proprietary datasets.

The Future: Sector ETFs & Index Products?

This evolution may be a stepping stone toward crypto sector ETFs or index-tracking tokens, which are gaining interest among wealth managers and fintech innovators. By standardizing category data, CoinGecko may help fuel the development of investable sector baskets—akin to the S&P 500’s sector indices.

Ong hints at more innovations on the horizon: “This is just the beginning. We’re working to bring even more actionable insights—especially for users who think in themes, not just tickers.”

Conclusion

In an age of data overload and fragmented token ecosystems, CoinGecko’s Smart Sector Categories represent a breakthrough in crypto intelligence. As users increasingly seek structure, clarity, and thematic access to opportunities, this feature could reshape how both retail and professional investors interact with the market.

Whether you’re chasing narratives or building a diversified strategy, tracking by sector may soon become the new normal in crypto investing.